Current Employment Status:

Hired Full Time on Apr 27, 2024

Profile Description

With a bachelor's degree in Bachelor of Science major in internal auditing. With 5 years of experience in Financial Accounting, Cost Accounting, Taxation, Human Resources, and Administrative.

Top Skills

Accounting » Financial Accounting

Experience: 2 - 5 years

Accounting Supervisor - Recording of transactions in the books of original entries following the generally accepted accounting principles and using chart of accounts suitable to the company’s business, Check and record sales and collections against invoices and billings, Preparation of the Creditable Tax Withheld at source (BIR form 2307), Inventory Management, Preparation of the monthly Financial Profit and Loss, schedules supporting selected balance sheet items; Year-end Trial Balance (For client external auditor with supporting schedules), Provide schedules of monthly and quarterly VAT returns including withholding tax returns on expenditures and compensation from which withholding tax was deducted and for remittance to the tax authorities, Preparation of monthly journal entries for depreciation, accrual, prepayments and other adjustments (if any), Assistance for annual Registration of Books of Accounts, Bank Reconciliations. BIR TAX COMPLIANCE: Preparation and Filing of BIR Annual Registration Fee (0605), Preparation and Filing of Monthly and Quarterly Vat Return (2550M/2550Q), Preparation and Filing of Monthly Withholding Tax-Expanded and Final Tax – if any (1601E/1601F), Preparation and Filing of Monthly Withholding Tax-Compensation (1601C), Preparation and Filing of Quarterly Income Tax (1701Q/1702Q), Preparation and Filling of Annual Alpha List of Withholding Tax Expanded (1604E), Preparation and Filing of Annual Alpha List of Withholding Tax Compensation (1604CF). PAYROLL: Maintain and update employee data and information, Prepare the payroll register which include all the information needed for the payroll period, Calculate the employee’s overtime, tardiness, absences, under time and other deductions based on the time sheet and on the company’s policy, Preparation of Bank Transmittal Report, Preparation of Pay Slip, Provide detailed management reports, Computation of Final Pay for resigned employee, Prepare monthly governmental reporting relevant to payroll, Prepare Alpha list for withholding tax on compensation, Prepare BIR 2316 (Certificate of Compensation Payment / Tax Withheld) for each employee, Report all year-end adjustment for the taxes withheld, Processing of Payment for Government Remittance (SSS, Pagiibig, and Philhealth).

Professional Services » Management Services » Accounting Management

Experience: 2 - 5 years

Accounting Manager - oversees the day-to-day accounting and finance operations including accounts payable, accounts receivable, cash flow, accounts/bank reconciliation. Ensure the proper implementation of policies, system and procedures in safeguarding the company’s assets and internal control through regular audit function of the company’s transactions. Prepare and review monthly report such as but not limited to: Management report (P&L Report), Balance Sheet, Aging Report, monthly, quarterly or yearly forecasts and outlook and budget, Tax filling in compliance with BIR regulations and other government mandatories. Establish, modify and coordinate implementation of accounting control procedures across all departments. Perform various administrative role and perform such as Human Resources, Purchasing, Admin. Attend seminars/events related to accounting and Finance, Human Resource when Management deemed necessary. Conduct regular inventory and audit of physical stocks, hardware, furniture and fixture, collections. Perform other functions assigned by the management.

Accounting » Financial Accounting » Internal Auditing

Experience: 2 - 5 years

Internal Audit Manager - my duties are review Company's financial statements, documents, data and accounting entries by gathering information from the Company's financial reporting systems, account balances, cash flow statements, income statements, balance sheets, tax returns and internal control systems. Present all financial data in an accurate, fair manner, ensuring that no fraud or gross errors are present in the company. Speak with multiple departments, including low- and high-level management teams, accounting and finance personnel, and company executives in the pursuit of analytical data and to gain understanding of the company's purpose, its operations, its financial reporting systems, and known or perceived errors in the organizational systems. Assess accounting and financial reports by testing the documentation of transactions that the company has provided. Analysis also includes observation of inventory and the processes used for managing inventory counts. Review accounts receivable, invoices, vendor payments and billing procedures to ensure compliance with accounting guidelines. Develop recommendations and specific action items for the organization where an audit was performed. Suggest changes to internal controls and financial reporting procedures to enhance the company's efficiency, cost effectiveness and overall performance. Perform other related duties as assigned for the purpose of ensuring the efficient and effective functioning of the organization. Other task; in-charge for creating costing system, inventory managements control process, variance reporting, and creating standard operating procedure.

Other Skills

Basic Information

- Age

- 32

- Gender

- Male

- Website

- Sign Up with Pro Account to View

- Address

- Makati City, Metro Manila

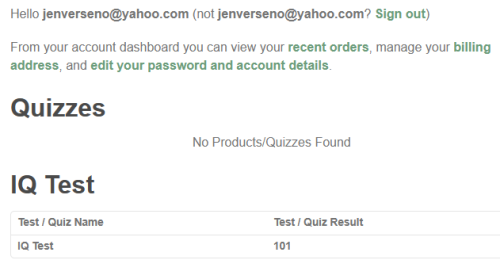

- Tests Taken

- IQ

- Score: 101

- DISC

- Dominance: 44%

- Influence: 7%

- Steadiness: 21%

- Compliance: 28%

- English

- B2(Upper Intermediate)

- Uploaded ID

- Sign Up with Pro Account to View

Onlinejobs.ph "ID Proof" indicates if "they are who they say they are".

It DOES NOT indicate skill level.

ID Proof scores are 0 - 99 with 99 being the best. It is calculated based on dozens of data points.

It's intended to help employers know who they're talking to is real, and not a fake identity.

You have successfully pinned this profile! You can manage pinned profiles in your Employer dashboard.

You have successfully pinned this profile! You can manage pinned profiles in your Employer dashboard.