Update 2024: This post is still correct and relevant today.

Disclaimer: I am not a Certified Public Accountant (CPA), nor am I a tax attorney. You should seek professional advice about your accounting and tax concerns.

While this blog post is directed mainly to employers based in the US, other than the specifics of which tax documents to use, the tax situation is much the same in most other countries.

We have consulted several accountants and tax attorneys for this (both in the US and the Philippines), and they all say the same thing. But I also encourage you to consult an accountant or tax attorney familiar with your local taxes.

How to handle taxes with Philippines outsourcing

When you employ Filipino VAs, taxes are simple.

Because Filipino VAs are foreign independent contractors rather than employees. You don’t have to worry about:

- 1099s,

- W-2s,

- benefits,

- unemployment,

- disability, or

- other IRS pains.

In fact, if you do things correctly, you have no obligation to report your VA’s wages to the IRS.

Your VA is solely responsible for taxes due to the Filipino government.

IRS migraine resolved!

How this works

The W-8BEN:

In the US, you are required to report wages and withhold 30% of those wages to the IRS.

However, because of the tax treaty between the US and the Philippines, if you have a W-8BEN, it allows you to have no tax liability, and you DO NOT have to withhold the 30%.

So, you must have a current W-8BEN form from each of your VAs.

A W-8BEN basically states that they are foreign individuals receiving American payment for services performed in the Philippines.

The W-8BEN should be filed in your records in case of an audit – to account for their payments as ‘business expenses.’

Here’s what they need to fill out in the W-BEN:

Line 1. Your OFS Name (this is what the form is calling a “beneficial owner”)

Line 2. Write “Philippines”

Line 3. Your OFS Address

Line 4. Your OFS Mailing address (if different than #3)

Line 6a. Your OFS BIR number (it’s like their IRS number)

Line 8. Your OFS Date of Birth

Line 9. Write “Philippines”

Lastly, they need to fill out this part:

The rest can be left blank.

Here’s an example of a W-8BEN form that one of our OFS team filled out.

The W-8BEN needs to be filled out every 3 years. You can find the document here: W-8BEN

Filipino Statements

In tandem with the W-BEN form, some advisors recommend keeping on file a signed statement from each VA stating that they are working on foreign soil and no services are being performed in the US.

Again, this is just for your personal records and is only needed in case of an audit. There is no official form for this statement. Just ask your VA to type it out, date it, sign it, and send it to you.

The 1120S

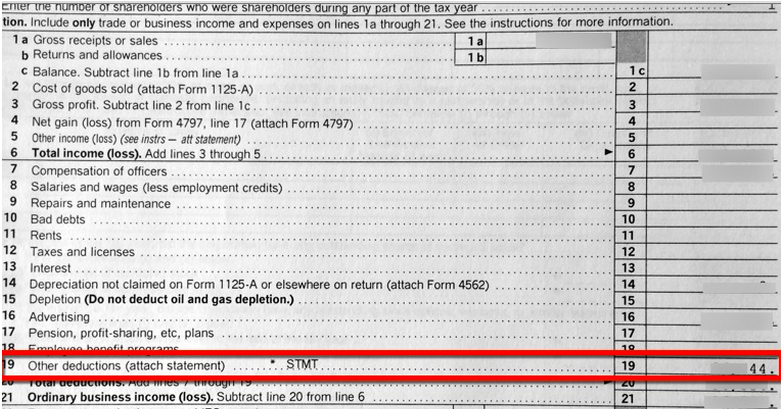

S corporations and LLCs will need to file an 1120S detailing business expenses. Here is a copy of what the form looks like and how you’ll include your Filipino VAs wages.

This is page 1 of the 1120S, or the tax form used for S corporations. Notice that payments to Filipino VAs are deductible business expenses reported on line 19 as “Other deductions.”

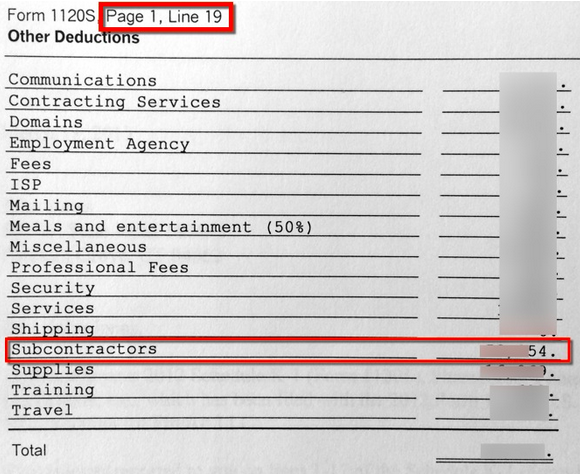

The “Attached Statement.”

The requested “attached statement” has no standard form. Simply type up a document stating which line you are referencing (Page 1, Line 19), the expenses you are claiming, and how much each expense was.

Here is an example of how our accountants have done this for us:

Notice that the top of the page specifies that this is explaining the details of 1120S Page 1, Line 19. Under this, we’ve listed various expenses that were lumped together under line 19, including “Subcontractors,” or our Filipino VAs.

And That’s It!

Side note:

Your VAs are considered foreign independent contractors.

You can’t declare them as employees if you don’t have a legal entity in the Philippines. A legal entity in the Philippines means that

- your business is registered with the Philippine government,

- you have a business address in the country,

- you have your VAs wear uniforms, and

- you control their work schedule.

If you don’t have that, the Philippines government will not allow you to act as an employer and call your VAs your employees.

Your VAs also don’t have IRS numbers, so they can’t give you one.

Also, there’s a treaty between the Philippines and the US where if you send money to an OFS in the Philippines, the Philippine government is responsible for taxing it.

Since you’re not required to pay taxes on your VAs, consider compensating them more generously. Remember that their government doesn’t provide social security, medical benefits, or disability coverage.

When you live in the US and can’t afford food, you can apply for food stamps. When you live in the Philippines and can’t afford food, you go hungry. The Philippines is still a developing country. Please take care of your employees.

If you want to learn more about how to avoid the issues most people encounter when outsourcing, check out my new book, Outsourcing Lever. It shows you what I and other successful entrepreneurs do to grow their businesses with virtual assistants.

About John Jonas

John Jonas is a long-time outsourcing expert and the creator of OnlineJobs.ph.

Since 2005, John has taught hundreds of thousands of entrepreneurs how to profitably delegate to VAs in the Philippines (and get their lives back in the process).

With help from his own VAs based in the Philippines, John has created an outsourcing empire that allows him to work 17 hours/week and to spend most of his time with his wife and 5 kids.

Find John at JohnJonas.com and Facebook.

If you liked this you’ll probably also like reading

Great article. Just finished my 1st year using my Filipino VA and could not be happier. Will use this tax form going forward with my 2015 taxes.

Thanks for the useful info!

Congrats Bonnie.

It keeps getting better from here!

If you’re a freelancer or solopreneur, I suggest you try out Taxumo.com as an easier way to file & pay for your taxes online. Hassle-free and easier than BIR’s platform! You can compute your tax dues and it even autofills BIR tax forms. 🙂

Actually, the Philippine government DOES provide medicare and social security. If you are not hiring them as employees, they should be paying a self-employment tax (just like US contractors do) which pays for these benefits. It’s actually the law in the Philippines to do so. Since they already charge a premium over local salaries that are available to them, you do not need to pay them anything on top of what they ask.

Greg,

This is one way of looking at it.

However, the “medicare” and “social security” you’re talking about aren’t like the medicare and social security in the USA.

Also, some of them “charge a premium” over local salaries, some don’t. I have a couple girls who work for me who are fantastic, but I know they made more working a job. They stick with me because their quality of life is better working from home than working a job.

We try to be fair with our workers.

Offering to give them some extra to pay for PhilHealth and SSS will go a long way towards building loyalty, and it won’t cost you that much.

I’m not saying it’s necessary, but in the long run, it should pay off very nicely.

John

John,

Could you tell me a little more about Philhealth and SSS in the Philippines? How much exactly does it cost and how much do you recommend someone pay extra toward it for an employ that is being paid around $250? Building loyalty and taking good care of our people is definitely something we want to do and I’d appreciate any details you have to offer (or a link if you’ve covered this elsewhere).

BTW, my wife and I are literally hours away from buying into your Pro plan and getting this adventure started. Very exciting!

Thanks,

Steven

@Steven,

Check out this post for more on the costs of SSS and Philhealth:

http://www.onlinejobs.ph/blog/comprehensive-guide-to-virtual-assistant-salaries-in-the-philippines

I’m by no means an expert on either of these things. From what I understand about Philhealth is it often covers the basics of health care, but not much more…and sometimes not even the basics. Here’s more:

http://www.philhealth.gov.ph/about_us/mandate.html

SSS is a form of “social security”, but different than in the USA. Here’s something to help you understand more:

https://www.sss.gov.ph/sss/appmanager/pages.jsp?page=ssbenefits

From what I understand, it promises a lot, but it’s hard to get paid from it. My team told me it’s more of a program to provide loans to Filipinos when they need it.

Hello,

I was working on getting the W-8Ben form filled out but I wanted to understand all the areas that needed to be filled out. Part 2 is really confusing on what I need to put in there. I tried a google search but wasn’t sure based on what I found. Do you have any more information on this section?

I’m not an accountant, so I’m not qualified to give you tax advice, but I believe you fill out fields 1, 2, 3, 6, 8. I think you leave the rest blank.

Thank you for sharing this to other people

google.com

Thanks so much for this very helpful article. It was recommended by a colleague and now I will be recommending it as well.

Hi,

thanks for the article. Does anyone know how this works in Germany / EU? Is there any similar form

Same for Canada. I have no clue how it works but a tax accountant should know.

And if they call in US businesses, we can’t say that “no services are being performed in the US”.

Aloha John,

I spoke to my accountant who agrees the W8BEN is the appropriate form for my circumstance, but that form 1120S is only for an S corporation, which I am not. However, in your article, you specify that form for S Corps and LLC’s. Am I missing something that I should advise my accountant?

Joy,

In the U.S., if you establish your business as an LLC, like many small businesses do, you have the option to elect your LLC to be taxed as an S-Corp for tax purposes. LLC’s have to apply to the IRS for this status (Form 2553) and most companies do this as soon as they are setup. My CPA set me up and completed the forms for me to mail as soon as my business was established. Some states also require you to apply as an S-corp directly to the State in which you operate as the Federal IRS S-Corp status isn’t automatically accepted or passed down. Check the benefits and requirements with your accountant, if you are an LLC, to see if it makes sense for your business to elect an S-corp status because you have to qualify. They should have all the information for you on this topic. Stay well.

What about hiring from Europe? I’m based in the Netherlands.

Hi Caroline,

Thank you for your comment.

I’m sorry if there is any confusion but we only allow Philippine citizens to be workers on our site. Unfortunately, at the moment we’re focusing in providing jobs mainly for Filipinos based in the Philippines.

For online jobs within your country, you can try signing up for UpWork or Freelancer.

I am actively looking for the possibility of outsourcing my IT helpdesk to Philippines and found this very interesting article. But I have a few questions: 1) does your VA also include IT helpdesk type of workers? 2) If my startup will be an C corp, or LLC with C corp tax election, does that mean I cannot use your service, maybe because I have to hire “employee” instead of “contractor” that are clearly different in the US? 3) For an LLC or LLC with S corp election, it sounds like I can hire Filipino contractors only, even if the contractors are actually working like “employees” as defined in the US? In other words, the IRS does not care the difference between contractors and employees as long as they are not physically working in the US? Thank you very much in advance!

Hi Jason,

Thank you for your comment. There isn’t a difference between how a worker is treated either as a contractor or employee depending on tax classification (c-corp vs s-corp, etc). Also, you can check this link when it comes to looking for IT helpdesk workers -> https://www.onlinejobs.ph/employers/advancesearch

Questions:

1. I’m in the US, and so would you classify these VAs as independent contractors or employees? I’m assuming providing them any sort of training immediately classifies them as an employee, correct? And so if this is the case, what other tax or financial requirements, in the US or Philippines, are required from me?

2. Do you have them sign a contract upon hiring them? What should be included in this contract? Do you have an examples of this? Thanks

Hi GT,

Thank you for your comment. Regarding your questions:

1. When you employ Filipino VAs, taxes are simple. Because Filipino VAs are foreign contract workers rather than US employees, you don’t have to worry about 1099s, W-2s, benefits, unemployment, disability or other IRS pains. In fact, you have no obligation to report your VA’s wages to the IRS. And your VA is solely responsible for taxes due to the Filipino government.

2. When it comes to contracts, you can check one of our blog posts regarding that very concern -> https://blog.onlinejobs.ph/use-contract-hiring-virtual-assistant-practical-advice

Hi there,

I have a business in Australia, do you have experience with this topic in that market?

Also, do you have a good contractor agreement template I can access?

Thanks!

Hi David,

Thank you for your comment. Our support team will email you regarding your inquiries, kindly check your inbox in case

Thank you so much for this advice!

My accountant told us to submit a 1042. Could anyone advise on this? And is W8 and 1120 mandatory? Thanks!

Hi Lia,

Thank you for your comment. We have a blog regarding that, you can check the video out for more information as well -> https://blog.onlinejobs.ph/taxes-contracts-employees-practical-advice

I will be hiring a philipino worker for a business which has its base in the UK and they will be working from Cebu from home.

2 questions..

1.tax treatment etc the same as the states ( no form though I think).

2. Is there a contract which you have a template for on site?? Thanks

Hi Kate,

Thank you for your comment.

We have a blog post relating to your inquiries. You can search “How to Handle Taxes with VAs – Practical Advice” and “Taxes, Contracts, and Employees – Practical Advice” in our blog or on YouTube